How can I de-risk my career and job search?

Feb. 03, 2021, at 07:30 PM

The answer of course is - ‘you can’t!’ It’s very hard indeed to avoid any wrong turns or setbacks over a long career in financial services which is known to pay more to offset the longer hours and relative insecurity compared to other sectors.

There are so many variables and so much is out of your control.

However, having a career plan and a sense of direction is something you can do to reduce the risk of making wrong turns or the opportunity cost of not hearing about the best opportunities.

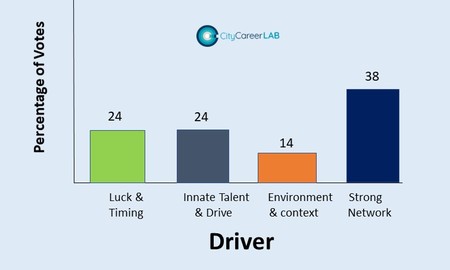

The majority of people make knee-jerk moves and career decisions that rely more on chance than anything else. It depends of course on getting a call from a head-hunter, seeing a job posting or hearing about an opportunity through an aquaintance. Bear in mind that a very large number of roles never even make it to the market in the first place and fly under the radar(especially at more senior levels). This is tantamount to being in the right place at the right time. You could argue that some people prefer to take their chances and/or back themselves to get what they want in the end, but it’s interesting to think that many of the same people will insure their property, cars and valuables, and no doubt hedge and plan their investments carefully - so why don’t they de-risk their careers. There is nothing wrong with this of course and it works for an awful lot of people a lot of the time.

However, there is another way of going about things that gives you more control. Imagine having a career goal or end destination in mind (or at least a shortlist of options), and then imagine having a list of pre identified target organisations that have similar roles and that share your values and ambition etc. When you have such a list you can start to network and/or build your profile with key decision makers in those organisations proactively rather than waiting for a chance encounter or call. This allows you to ‘take back control’ (no brexit pun intended) and potentially gives you access to opportunities that you wouldn’t otherwise hear about. It also means you are one step ahead of the competition if you find yourself a victim of a restructure or on the wrong side of an acquisition.

I often reflect on the fact that anyone entering the industry via a graduate position or even an apprenticeship will no doubt have spent a long time researching possible roles and employers, but how many of them or the wider workforce apply the same principles to any subsequent career moves they make? The answer is ‘not many’.

A Career Coach with knowledge of the FS industry can help you think through some of these questions and take back control of your career before it takes control of you. Contact City Career LAB for more information.

There are so many variables and so much is out of your control.

However, having a career plan and a sense of direction is something you can do to reduce the risk of making wrong turns or the opportunity cost of not hearing about the best opportunities.

The majority of people make knee-jerk moves and career decisions that rely more on chance than anything else. It depends of course on getting a call from a head-hunter, seeing a job posting or hearing about an opportunity through an aquaintance. Bear in mind that a very large number of roles never even make it to the market in the first place and fly under the radar(especially at more senior levels). This is tantamount to being in the right place at the right time. You could argue that some people prefer to take their chances and/or back themselves to get what they want in the end, but it’s interesting to think that many of the same people will insure their property, cars and valuables, and no doubt hedge and plan their investments carefully - so why don’t they de-risk their careers. There is nothing wrong with this of course and it works for an awful lot of people a lot of the time.

However, there is another way of going about things that gives you more control. Imagine having a career goal or end destination in mind (or at least a shortlist of options), and then imagine having a list of pre identified target organisations that have similar roles and that share your values and ambition etc. When you have such a list you can start to network and/or build your profile with key decision makers in those organisations proactively rather than waiting for a chance encounter or call. This allows you to ‘take back control’ (no brexit pun intended) and potentially gives you access to opportunities that you wouldn’t otherwise hear about. It also means you are one step ahead of the competition if you find yourself a victim of a restructure or on the wrong side of an acquisition.

I often reflect on the fact that anyone entering the industry via a graduate position or even an apprenticeship will no doubt have spent a long time researching possible roles and employers, but how many of them or the wider workforce apply the same principles to any subsequent career moves they make? The answer is ‘not many’.

A Career Coach with knowledge of the FS industry can help you think through some of these questions and take back control of your career before it takes control of you. Contact City Career LAB for more information.